0xCoast

0xCoast

Discovered: Circa 2019.

Discovered By: Richard Heart

Associated Projects: HEX.com, PulseChain.com, Scivive

The invention of decentralized exchanges (DEXs) that hold infinite-range liquidity created new market dynamics for the cryptocurrency industry. Having all trading volume being visible, on chain (rather than hidden on centralized exchanges) allowed industry experts to see new paradigms.

Because Uniswap (the most popular DEX) operates on the Ethereum blockchain, most coins organically traded against Ethereum as their primary pair. This was true of wBTC (Wrapped Bitcoin), TORN (Tornado.cash) and HEX (HEX.com) and later UNI (Uniswap.org) when they released their own token.

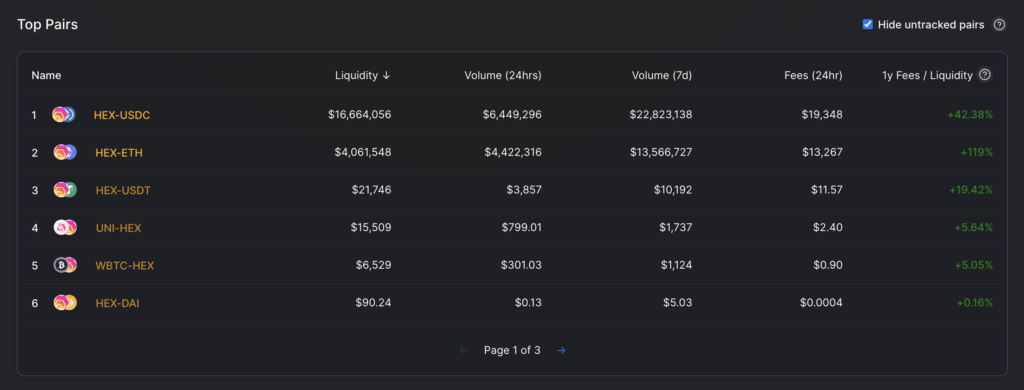

Heart’s Law… that price movements of interchangeable assets are bonded via the liquidity in their pairs was recognized by Richard Heart after he observed that the price of wBTC, ETH and HEX tended to move in tandem based on the liquidity of their Uniswap pairs. As a result, he encouraged LP providers in the HEX Community to remove their liquidity from the HEX-ETH pair, and instead to place it on the HEX-USDC pair. This has since resulted in the price of HEX becoming de-correlated from price movements of both ETH and BTC.

To demonstrate the correlation between the price movements of different bonded cryptocurrencies, please see below. Notice that the ETH-USDC and BTC-USDC charts move in lockstep. Is this because Ethereum and Bitcoin have the same value proposition? No. The same use case? No. It’s because, as Heart’s Law explains, they are bonded by liquidity. ETH and BTC primarily trade against one another so their price charts are correlated.