As part of our ongoing series exploring the pools on TIDE—a fork of Balancer V3 tailored for the PulseChain ecosystem—we’re taking a deep dive into the Buy HEX pool. This pool combines 80% HEX and 20% CST (Coast token) to create a liquidity environment that minimizes impermanent loss (IL) while reducing slippage for users onramping to PulseChain.

TIDE, built by the Coast team, brings the advanced features of Balancer’s weighted pools to PulseChain, where traditional DEXes like PulseX rely on 50/50 splits. If you’re familiar with Balancer’s documentation, you’ll recognize the mechanics here, adapted for PulseChain’s low-fee, high-speed environment.

This post will cover the assets involved (HEX and CST), the rationale behind the 80/20 split including its benefits and limitations, a detailed comparison of impermanent loss versus a 50/50 pool (like those on PulseX), and a profile of the ideal investor for this pool. Whether you’re a liquidity provider (LP) or a trader, understanding these details can help you make informed decisions in the PulseChain DeFi space. For more on TIDE, visit the TIDE DEX.

HEX is a flagship cryptocurrency on PulseChain, often described as the world’s first blockchain certificate of deposit (CD). Launched by Richard Heart, HEX rewards users for time-locked staking, offering potentially high annual percentage yields (APY) through an inflationary mechanism that benefits long-term holders. On PulseChain—a fork of Ethereum designed for faster transactions and lower fees—HEX serves as a key asset for yield farming and speculation.

Key features of HEX:

In the Buy HEX pool, HEX represents the volatile, growth-oriented side, allowing LPs to maintain significant exposure to its upside potential without staking (keeping assets liquid).

CST, or Coast token, is a PRC-20 utility token issued by the Coast team exclusively on PulseChain. With a market cap of approximately $11 million, CST is designed for direct onramping to PulseChain. Learn more about the Coast token $CST.

Key features of CST:

In this pool, CST acts as the onramp anchor, enabling efficient trades for users converting to HEX while providing LPs with exposure to ecosystem growth.

TIDE leverages Balancer V3’s weighted pool technology, allowing custom asset ratios unlike the fixed 50/50 model on PulseX. The Buy HEX pool uses an 80% HEX / 20% CST weighting, meaning the pool’s value is allocated 80% to HEX and 20% to CST at equilibrium. Explore TIDE’s features further here.

Overall, the 80/20 design prioritizes HEX exposure and onramp efficiency, but it’s a trade-off—gaining upside protection at the cost of downside vulnerability.

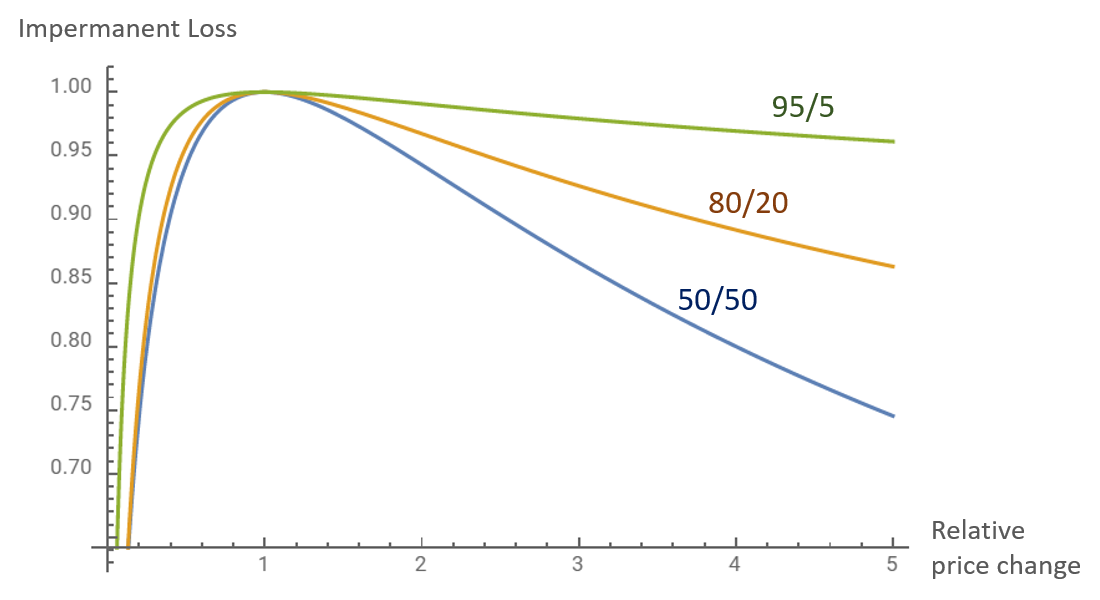

Impermanent loss (IL) is the opportunity cost of providing liquidity versus simply holding assets. In weighted pools like those on TIDE (forked from Balancer), IL is calculated using the formula:

IL = 1 – (r^w) / (w · r + (1 – w))

Where:

r = price ratio (new HEX price / initial HEX price, relative to CST)

w = weight of HEX (0.8 for this pool)

For comparison, a 50/50 pool (like on PulseX) uses w = 0.5.

Here’s a table comparing IL for various HEX price changes:

| Price Change | 80/20 IL (%) | 50/50 IL (%) |

|---|---|---|

| Doubles (r=2) | 3.27 | 5.72 |

| Halves (r=0.5) | 4.28 | 5.72 |

| 5x (r=5) | 13.72 | 25.46 |

| /5 (r=0.2) | 23.35 | 25.46 |

As shown, the 80/20 pool significantly reduces IL when HEX appreciates (e.g., 13.72% vs. 25.46% at 5x), but increases it slightly on moderate declines and more on sharp drops. This makes it superior for bullish scenarios, aligning with HEX’s growth narrative. For more on Balancer’s IL mechanics, refer to

This pool is tailored for a specific type of investor on PulseChain:

If you’re a conservative holder or expect HEX volatility to the downside, a 50/50 pool or simple holding might suit better. Always DYOR and consider fees, volume, and personal risk tolerance. Read about CST’s launch on PulseChain.

The Buy HEX pool exemplifies TIDE’s innovation on PulseChain, using Balancer V3’s weighted mechanics to create a user-friendly, efficient liquidity venue. By blending HEX’s growth potential with CST’s utility in an 80/20 ratio, it minimizes slippage for onramping while offering LPs reduced IL on bullish moves. Stay tuned for more deep dives into TIDE pools, and check out the upcoming TIDE docs for PulseChain-specific details.